Calculating the Value of Good Jobs

Introducing the good jobs calculator

Calculate the value of

the gAn excel-based financial model built to enable companies to project the value of implementing the Good Jobs Strategy

download hereMaking the leap to good jobs can feel financially daunting. The costs of providing good jobs, such as wage or benefit increases, are immediate and easy to quantify, while the greatest benefits, including revenue uplift and cost reduction, are further out and harder to quantify. Indeed, the costs of continuing with the status quo are often hidden.

To illustrate the possible uplift of a good jobs system, GJI has created the “Good Jobs Calculator.” Using different assumptions about the amount of improvement or uplift achievable, executives can run scenarios on the bottom-line impact of a good jobs system. In addition to giving an overall “size of prize” range, quantifying these benefits can help them understand what would have to be true — specific improvements in metrics like turnover, shrink, and basket size — to justify a given investment in creating a good jobs system.

Read our HBR piece "The Financial Case for Good Retail Jobs"

Three types of financial benefits

To make the financial case for increasing a company’s investment in its people and improving their work, retail executives can quantify three types of benefits.

1. Cost Mitigation

Existing P&L costs that could be reduced through a stable workforce and improved operational execution

Retail Examples:

▪ Employee turnover

▪ Inventory shrink

▪ Overtime pay

2. Revenue Uplift

Potential increases in revenue stemming from improved operational execution and higher customer satisfaction and loyalty

Retail Examples:

▪ Fewer stockouts

▪ Higher transaction size

▪ Increased traffic

▪ Higher conversion

3. Labor Productivity Gains

Hours spent on activities that do not add value for customers and frustrate employees, that could be redeployed to higher-value activities

Retail Examples:

▪ Managing absenteeism

▪ Dealing with long delivery windows

▪ Repeatedly resetting displays

Using the Good Jobs Calculator Method: Grocery Co.

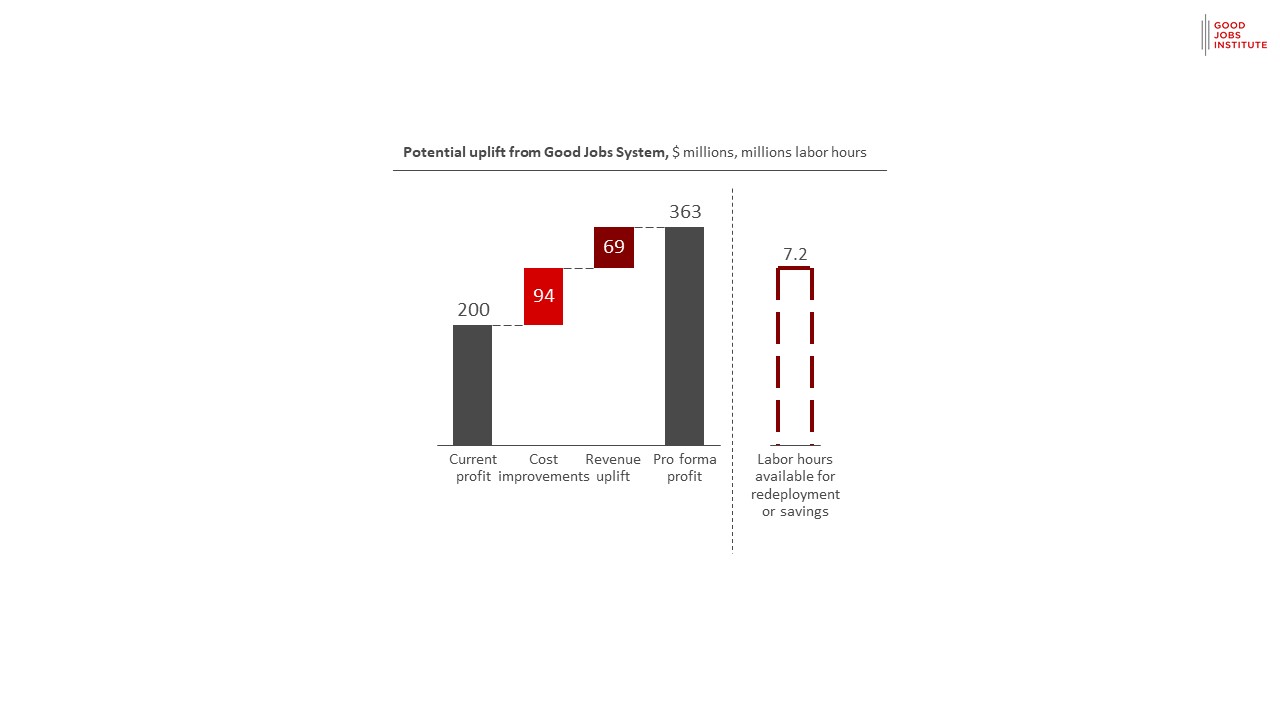

As an example of how executives may quantify the upside, we created GroceryCo, a fictional 500-store grocery chain. It has $9 billion in annual revenues and $200 million in profits. It has industry-average performance in employee turnover (60%) and in operational execution (3.6% shrink, 4.0% stockouts, 0.5% abandoned transactions).

For GroceryCo, a 25% improvement in employee turnover, shrink, stockouts, and abandoned transactions would amount to nearly $120 million in operating income impact — nearly 60% of current total profits. We estimate that with a good jobs system, GroceryCo could free up 7 million hours in redeployable labor each year.

Read the Grocery Co. Calculator Methodology

Case study: Aetna

Good Jobs Calculator focuses on retail, but this approach can be used in many industries. Aetna raised wages in 2015. Here's their story.

When Aetna’s CEO, Mark Bertolini, found out that many of their fulltime call center employees were relying on government assistance and could not even afford Aetna insurance, he was shocked "that we as a thriving organization, as a successful company, a Fortune100 company, should have people that were living like that among the ranks of our employees."

Bertolini and his team calculated that raising for about 5700 workers would cost Aetna $27 million. But Bertolini also believed it could pay for itself by making workers more productive and increasing retention. To figure out how much better jobs could boost performance, the Aetna team did an analysis of all the potential benefits of raising wages—reduced turnover, better attendance, ability to focus on the job and therefore offer better service, and so on.

The numbers convinced them that it made sense to raise wages so, in 2015, they raised the minimum wage from $12 an hour to $16 an hour. "I think it's a pretty good bet that we're going to find a way to cover those costs in the long run," Bertolini says. "We don't see it (profits) suffering at all."

Read about the changes Aetna made & how they did it.

- Creating A Social Compact with Employees

- Aetna Press Release on Wage Changes

- PBS, "Good pay, good worker, good company? Aetna CEO thinks so"

- NPR, "Health Insurer Aetna Raises Wages For Lowest-Paid Workers To $16 An Hour"